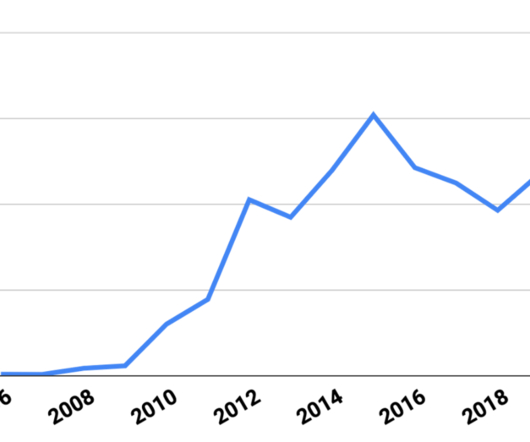

Growth of SPACs Prompts Concerns Over Audit Quality

Intelligize Blog

MARCH 19, 2024

Special purpose acquisition companies – more commonly known as SPACs – have seemingly disappeared from the investing scene in recent years. After a tidal wave of SPACs washed over the public markets in 2020 and 2021, they quickly fell out of favor with investors. Lordstown Motors Corp.

Let's personalize your content