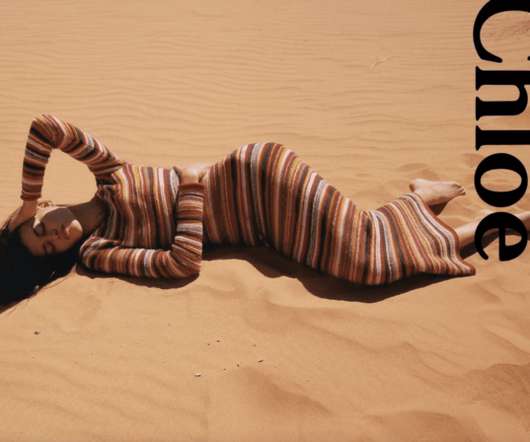

As Chloé Becomes a B Corp, What Does the Increasingly Popular Certification Really Entail?

The Fashion Law

OCTOBER 18, 2021

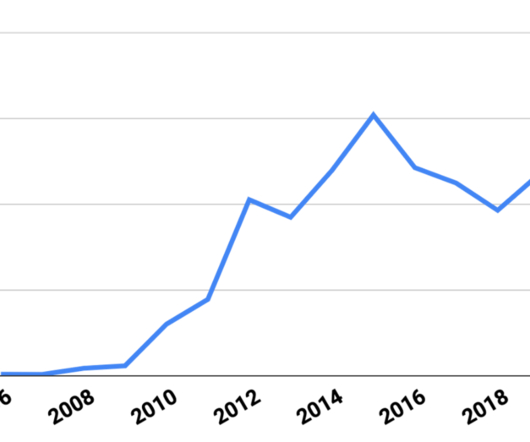

Consumers and investors are increasingly taking into account companies’ efforts on the Environmental, Social and Governance – “ESG” – front, with investors, in particular, scrutinizing companies’ sustainability credentials with more frequency and robustness than in the past. The Rise of the Fashion B Corp.

Let's personalize your content