Singapore High Court convicts two for $6B penny-stock manipulation

JURIST

MAY 8, 2022

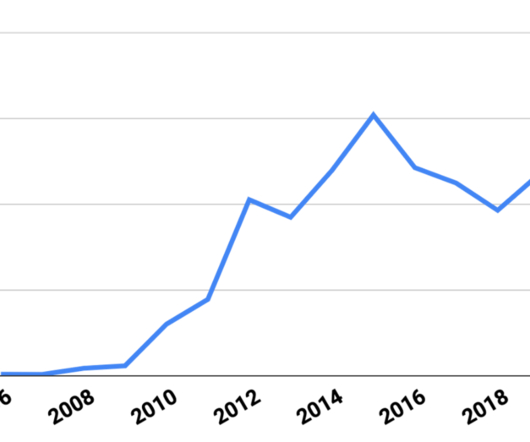

Chee Wen and Su-Ling carried out manipulative trades by using 187 trading accounts to artificially inflate the share prices of several penny stocks, which include Asiasons Capital, Blumont Group and LionGold Corp. One investor said he had invested SGD120,000 in Blumont Group, just before the crash.

Let's personalize your content