The idea of attending college and graduating with a degree has long been an integral part of the American dream. Some argue that due to the rising costs associated with higher education, pursuing it is not worthwhile. However, studies have shown that people with a degree tend to earn significantly more over their lifetime than those without.1 A college degree is strongly correlated with higher earnings and better employment opportunities. This fact alone should make pursuing a degree worth considering.

The idea of attending college and graduating with a degree has long been an integral part of the American dream. Some argue that due to the rising costs associated with higher education, pursuing it is not worthwhile. However, studies have shown that people with a degree tend to earn significantly more over their lifetime than those without.1 A college degree is strongly correlated with higher earnings and better employment opportunities. This fact alone should make pursuing a degree worth considering.

Accredited colleges and universities offer several types of financial aid, one of which is the availability of federal loans that students can access to pay for higher education.2 Federal aid can also cover other necessary living expenses such as housing, transportation, food, clothing, childcare, etc. This is especially crucial for students struggling to balance personal expenses while still attending classes.

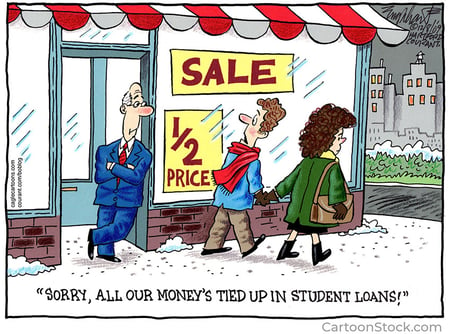

Loans can make college more accessible, but borrowing excess money for personal expenses can have long-term consequences. A primary concern may be how to fund your education and manage everyday costs beyond tuition and fees. It is equally important to evaluate the potential difficulties you might encounter when it comes time to pay back your loan. Federal loans are often offered and accepted at the maximum amounts, but there are lifetime aggregate limits for undergraduate study. You could quickly reach these limits if you take the full amount each year. This could put you at risk of becoming ineligible for additional funding before you can complete your degree. Financial aid provides a means for students to fill gaps in their ability to pay for higher education. It can also create debt at a time when students earn the lowest, and that debt balance can take years to repay. According to the Office of Federal Student Aid, a low debt burden is a monthly payment of less than 8% of monthly income.3

All students should explore ways to minimize their reliance on loans and reduce their debt burden. Ask yourself if you can afford the monthly payments before taking on extra debt, especially since several federal student loans begin to accrue interest as soon as the money is disbursed. The more you borrow now, the higher your monthly loan payment will be after graduation. How will you manage to pay off that debt and earn enough to support yourself and your family? Will you have enough money left over to repay what you borrowed? If you default on your loan, it can lower your credit score and negatively impact your credit history. A lower credit score can also make it difficult to borrow in the future, consolidate debt, and pay off accumulated debt at a lower interest rate.

There is a solution: why not ask your college to bring their classes to you? Attending classes online typically requires only a computer and a stable, high-speed internet connection at a designated time each week. Online learning formats can eliminate commuting costs and other traditional college living expenses like room and board enabling you to earn your degree comfortably from home. This could significantly reduce your student loan debt, potentially by half or more!

Center for Advanced Legal Studies (CALS), like other colleges, offers a 100% online course delivery format for its programs. Students attending CALS can join their instructor and classmates online to attend rigorous paralegal classes two evenings every week. CALS designed its Paralegal Certificate program for college graduates. Undergraduates can also apply and, if accepted, stack credentials on top of one another as they pursue their paralegal associate degree or Bachelor of Arts: Law and Business degree. If you have a stable home life and can dedicate extra time to college study, you may be an ideal candidate for the online programs at CALS. Although students must pay tuition and fees, our financial aid office can often help them cover these educational expenses.

Be smart when taking out student loans. Overborrowing for education may result in a prolonged student lifestyle even after graduation. Just because you can borrow for costs beyond tuition and fees does not mean you should. Student loan debt reduces disposable income. It restricts the money available to spend on bills and other essential needs. It also limits discretionary spending on things that make life more enjoyable. Managed poorly, loan debt can have economic consequences post-graduation, impact financial stability, and contribute to delays in making important life investments. Along with regular living expenses, the burden of repaying student loans with interest can be overwhelming. Instead, it is advisable to pay as much as possible towards your education while attending school and borrow only what is necessary to graduate with the least possible debt.

1 https://www.ssa.gov/policy/docs/research-summaries/education-earnings.html

2 https://studentaid.gov/

3 https://studentaid.gov/help-center/answers/article/student-loan-debt-burden

Doyle R. Happe

Co-founder and Director

Center for Advanced Legal Studies