How to Make an Attorney Billing Statement (Sample Included)

By Morgan Martinez

Sep 9, 2022

| 9 min read

If you could change anything about your practice with the snap of your fingers, what would you choose? Many lawyers would say their time-consuming billing and invoicing processes. After all, most would rather spend time helping clients than completing administrative tasks.

Fortunately, your firm can speed up invoicing using an attorney billing statement—a customizable invoice template. In this guide, we’ll cover the following topics.

- How to establish an efficient pre-billing process that positions your firm for success

- Features that every attorney invoice should contain

- A sample attorney billing statement (and how to use it)

- Attorney billing best practices that can help improve cash flow

How to Prepare for Invoicing and Billing

Crafting a profitable invoicing and billing system starts long before sending a client invoice. Below are a few strategies that can set you up for success.

1. Set Your Fees

Pricing is at the core of law firm profitability, but it can be tough to know what to charge.

Set your fees too low, and you’ll struggle to drive a profit. Set your fees too high, and prospects may choose your lower-priced competition. Additionally, lawyers are required to charge “reasonable” fees, as the American Bar Association explains.

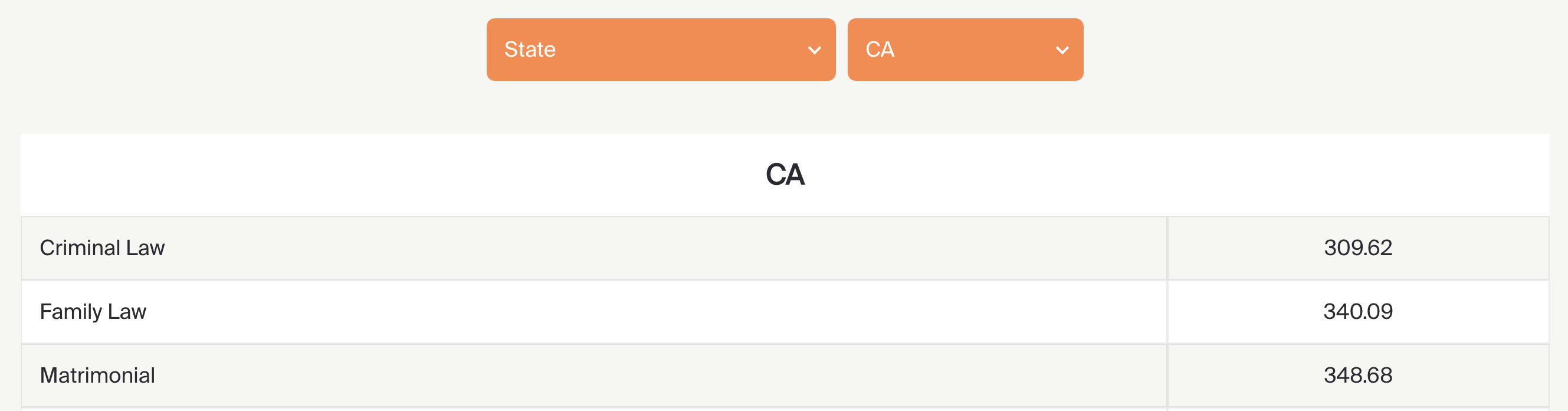

That’s why benchmarking is so important. If you want to know where you stand in the pack, check out our interactive hourly rate tool. It offers average hourly rates for lawyers by practice area and geographic location based on anonymized data from MyCase legal practice management software.

2. Proactively Communicate With Clients

When building positive client relationships, communication is a make-or-break factor. Explain your scope of services and essential invoicing and billing details from the start, so everyone’s on the same page. You’ll also want to touch on the following topics in your attorney-client contracts and the onboarding process.

- Fees (broken down by attorney or practice area, if necessary)

- Attorney invoice schedules (e.g., monthly or upon reaching certain milestones)

- Payment terms, such as how quickly they’ll need to pay

- Available payment methods, such as credit cards and ACH

This can ensure that clients don’t receive any unpleasant surprises that negatively impact their experience with your firm. Proactive communication may also help your law firm get paid more often and faster.

Tip: Read our attorney-client interview guide to discover what else you should cover in your consultations, in addition to fees and billing.

3. Capture Every Minute

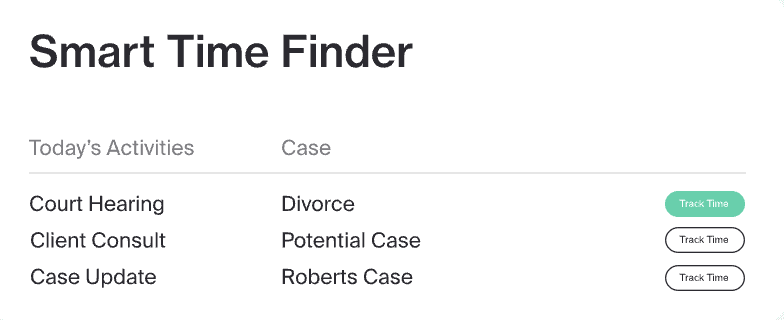

The most accurate attorney invoices track every minute. With MyCase time-tracking software, for example, you can start and stop up to three timers. With this feature, you can capture and log all billable time as you switch between matters. If you forget to start a timer, our software will alert you to track time when you complete a task, such as sending an email.

You can also take advantage of the MyCase Smart Time Finder. This built-in system identifies overlooked actions and allows you to create associated time entries quickly. Lawyers who leveraged Smart Time Finder in 2021 billed an extra 25 hours on average, or $8,600 in additional revenue (as explained in our Benchmark Report, Part 1: How Work Gets Done in Law Firms).

Once you’ve logged time with MyCase time-tracking software, instantly convert entries into invoices and easily send out bills. This eliminates redundant administrative work and helps you get bills out on time.

What’s Included in an Attorney Billing Statement

Invoices vary by firm. However, every legal billing template should contain a few key elements to simplify your accounting procedures and read as a client-friendly document.

Details of Your Law Firm and Client

A billing form should list the bill recipient and sender. For a legal billing template, this may mean your law firm’s and the client’s:

- Name

- Address

- Phone number

- Email address

The Date

An attorney invoice should include the date of issue—the day the invoice goes out to the client.

Itemized List of Services and Associated Costs

Often the most time-consuming part of an invoice, an itemized list of services breaks down the invoice total into sub-tasks and their associated costs. This serves multiple purposes.

- Promoting transparency around fees, so clients understand where their money is going. This helps prevent sticker shock and can help you proactively address concerns.

- Allowing clients to ask questions about specific services and rates

- Increasing accountability around billing. If lawyers must list all line items, they’re less likely to pad bills.

- Ensuring bill accuracy (which can be facilitated by automated time tracking)

When creating an itemized list of services, briefly describe the services provided. For example, your firm may have “prepared documents for a client meeting.” Then, include the amount of time spent on each service. Lawyers billing by the hour typically track time in six-minute increments.

If it took 24 minutes to prepare client documents, for instance, you would log 0.4 hours for that line item. Finally, include the billing rate for each service. This could be an hourly rate or a flat fee.

Expenses

Include any applicable expenses on your bill template, such as filing costs or court fees.

Totals, Subtotals, and Taxes

Once you have itemized services, calculating totals and subtotals should be easy. In fact, many invoicing programs do these calculations automatically.

To calculate a total for each service, simply multiply the time spent on the task by the service rate. For example, if you spent 0.4 hours preparing client documents and your hourly rate was $250, the total owed for that service is $100.

After determining the total for each service, combine all totals to get the invoice subtotal. Don’t forget to incorporate the appropriate percentage of service tax for your state on the billing form—you can list the tax rate and the total tax amount in dollars. Add the subtotal and tax amount to reach the final invoice balance.

Statement Due Date and Penalty Late Fees

The statement due date is important, as it tells clients when they need to pay the invoice. You can also list a breakdown of late fees if they don’t fulfill the bill on time. Late fees can be associated with a percentage of the invoice amount or a flat fee per day (up to a cap).

Check with your state bar association before implementing late fees on your bill template. Some state regulations may restrict the amount you can charge every year.

Payment Methods

Explain how clients can fulfill payments. If you accept checks, provide the recipient’s name and mailing address.

You should also discuss payment methods with clients at the start of every matter and include details in your attorney-client agreement. Clients shouldn’t receive this information for the first time on the billing form. This can create an overall negative experience.

Trust Account Balance and Details

Does your firm manage client trust accounts? An attorney invoice is a great way to update clients about their trust account balance. You can even feature a list of trust account transactions (debits and credits) to keep your team and clients on the same page.

Sample Attorney Billing Statement

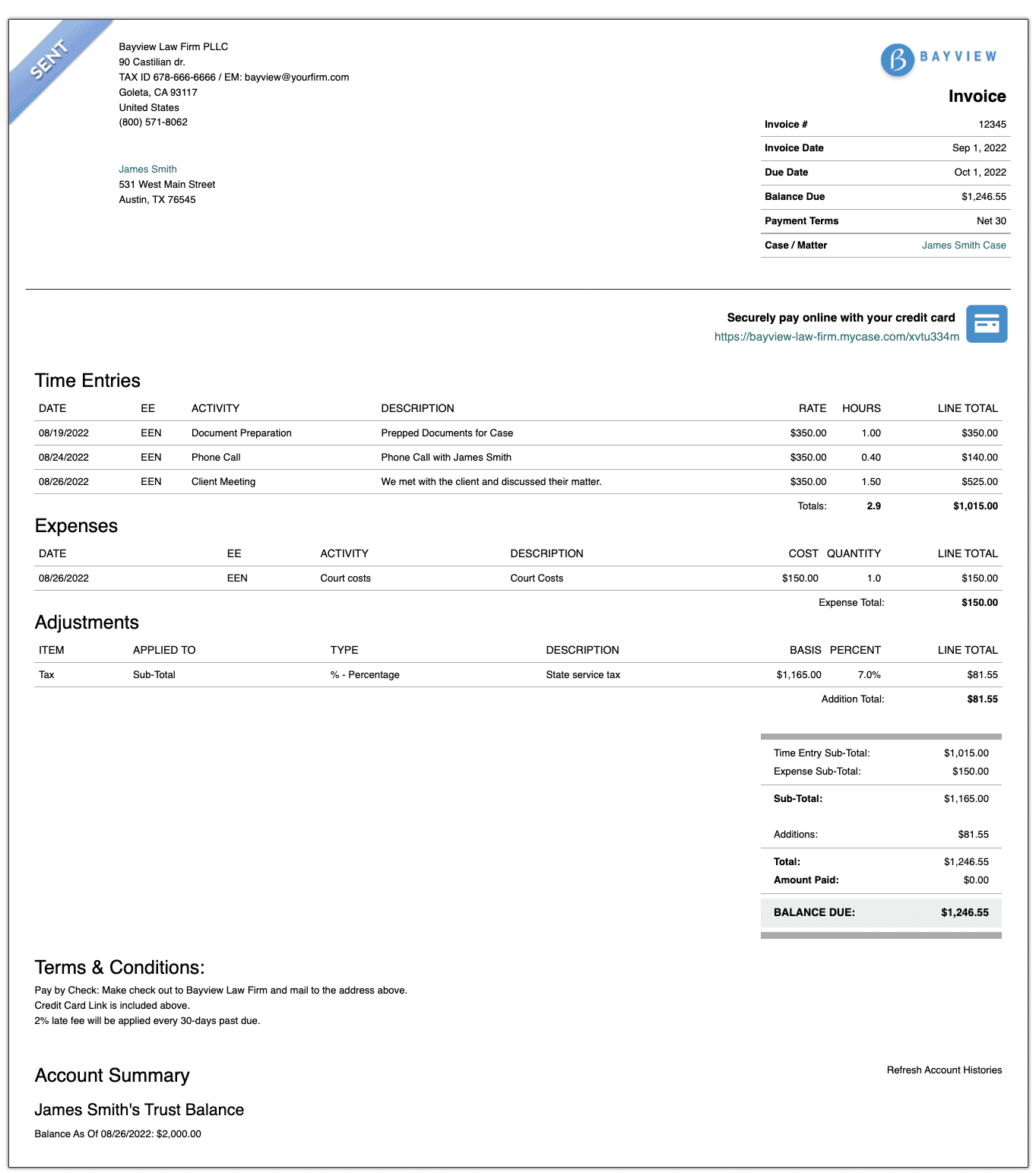

Now, let’s combine all of these pieces into one bill template. Check out the sample attorney billing statement below, created in minutes using MyCase legal invoicing software. Then, learn how to use the template to create your own invoices.

How to Use the Sample Attorney Billing Statement

There’s no need to spend hours revising our sample attorney billing statement to create your own template. With MyCase, your firm can develop customized invoices and easily send bills to every client. Use time-tracking entries or flat fees to generate invoices. Then, choose what information to include, such as the following.

- Attorneys and staff who worked on the case, their billable tasks, and their billable rates

- Payment terms (e.g., net 30, net 15, or due upon receipt)

- Payment methods

- Late fee amount (you can also decide whether to automatically apply late fees if the invoice is overdue)

Afterward, you’ll see when a client views or takes action on an invoice. MyCase also allows you to automate invoice reminders.

Attorney Billing Best Practices

Using billing and invoicing software to create a customizable bill template can help free up billable time. To further improve your process and increase collections, try these four attorney billing best practices.

1. Offer Multiple Payment Options

If you allow clients to pay by their preferred method (paper check, eCheck, or credit card), your firm is more likely to collect. Fortunately, accepting electronic payments doesn’t have to be complicated. LawPay, the industry leader in legal payments, integrates seamlessly with MyCase to streamline your billing and invoicing system.

2. Try Payment Plans

Do many of your clients struggle to fulfill their bills? Consider offering payment plans, which break fees into installments. This can be more affordable for clients and ensure a more consistent cash flow for your firm.

3. Look at the Landscape

Stay informed about your firm’s finances with MyCase financial analytics. For instance, you can use the “Trust Account” reports to track trust account balances and ensure compliance with state laws. Or, use the “Aging Invoices” report to see all outstanding balances owed to the firm.

With financial data and case analytics, you’ll stay well-informed about your firm’s current and projected finances.

4. Be Consistent and Clear

In billing, predictability is the name of the game. Send your invoices and reminders regularly, so clients know when to expect them and can budget accordingly. A consistent billing schedule also helps facilitate punctual attorney time-tracking and makes cash flow more predictable.

Attorney Billing Statements Simplified

Creating a legal billing template can be complex and time-consuming—but it doesn’t have to be. Let us handle the heavy lifting so you can focus on growing your practice.

Get your 10-day free trial of MyCase today, and find out why more than 14,000 law firms use our legal practice management software to improve efficiency.