VitalLaw: Everything You Need to Master The Area Of Securities Law

VitalLaw offers in-depth coverage in 38 practice areas, and, as the flagship area where VitalLaw started, Securities and Capital Markets is one of the most robust.

Photo Courtesy of Wolters Kluwer.

Securities law is one of the most complex areas of practice in the legal industry. Lawyers who specialize in securities law need to stay on top of a world of laws and regulations that are constantly evolving.

Wolters Kluwer has come up with the best way to do just that. The company recently announced that its award-winning research platform Cheetah has been rebranded as VitalLaw – a truly native digital approach to legal research that also provides practitioners with streamlined workflows that allow them to gain better insights and develop expertise.

VitalLaw offers in-depth coverage in 38 practice areas, and, as the flagship area where VitalLaw started, Securities and Capital Markets is one of the most robust. With VitalLaw, you can now access primary source content, interactive dashboards, all federal and state laws, tools that allow for more efficient workflows, and much more.

When you need to do deep research in securities law and make sure you’re staying on top of the current state of the law, you need VitalLaw Securities.

VitalLaw Securities Content

The Securities and Capital Markets practice area of Vital Law is designed to meet the specific needs of specialists in these areas.

VitalLaw’s rich universe of content includes treatises, acts and statutes, a complete set of forms, and more. There are news and blogs that provide current awareness information, including two dailies – the Securities Regulation daily, which provides deep insight from VitalLaw’s attorney editors, and the SEC Today daily, which profiles major filings and rule activity from the SEC.

This area of VitalLaw has its focus on compliance, structuring transactions, and document drafting. It provides a broad set of resources to assist with those tasks, including expert guidance and helpful workflow tools.

The practical content you’ll find in the securities area on VitalLaw, including guides and summaries, has been culled from the larger body of securities law content, making it easier to access.

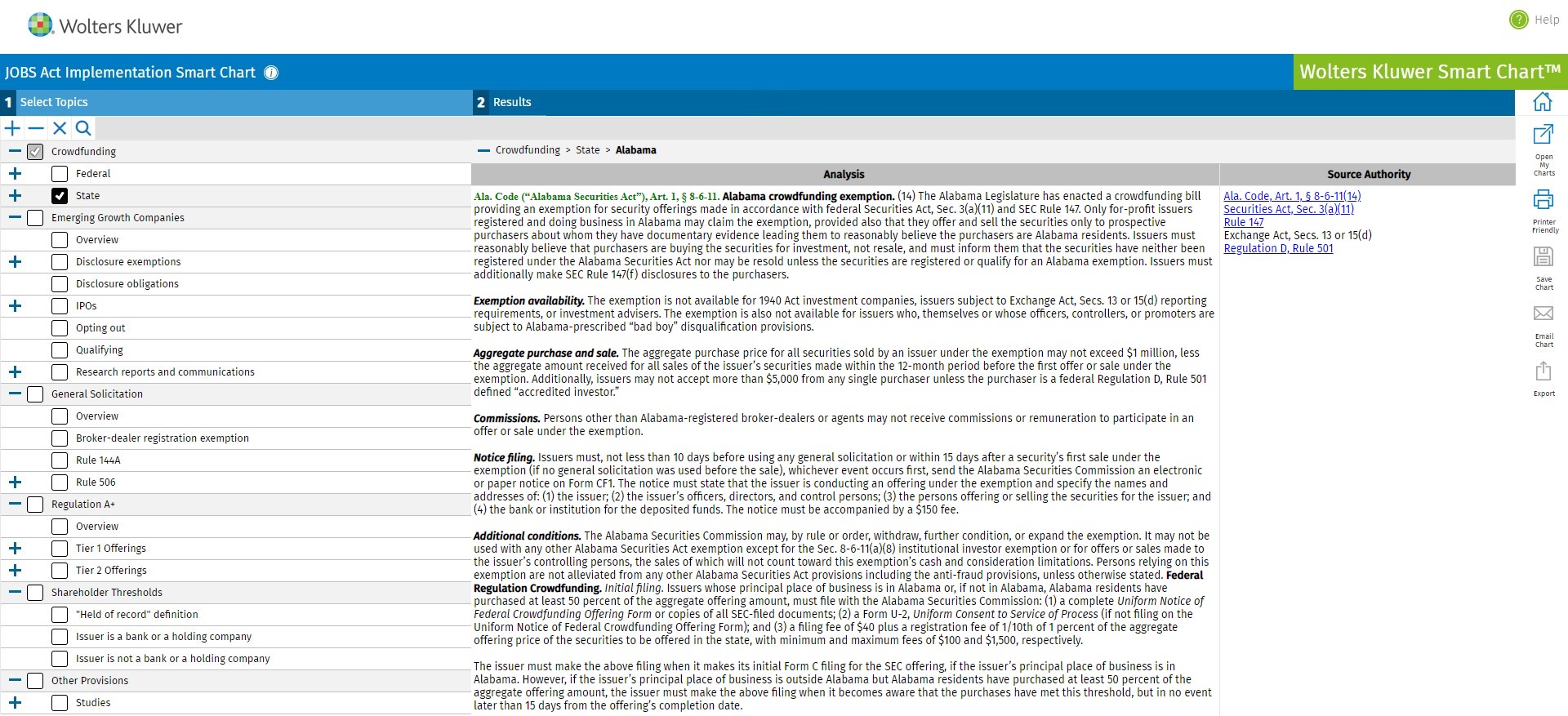

SmartCharts are critical to understanding how securities laws are being applied and enforced across various jurisdictions. For example, you can pull up a SmartChart on the JOBS Act and see essentially a 50-state survey of its application across the country.

SmartCharts are a convenient way to break down complex laws into their components. They can also be viewed by jurisdiction, giving you a sense of how different states are applying the law, or whether they’ve implemented it at all.

Another genius element of VitalLaw is SmartTasks, which guide attorneys through concrete job tasks, such as creating a filing or preparing a transaction.

SmartTasks provide step-by-step best practices for completing every element of tasks, transactions, forms, filings, and more. There’s no better way to know that your work is accurate and that you haven’t missed any critical aspects of a task. In a practice area with as much on the line as securities and capital markets, the peace of mind you get from SmartTasks is a game-changer.

Other practical content in the securities area includes quick answer books and checklists that help you ensure you’ve covered all your bases on a particular kind of project. You also get access to VitalLaw’s Laws & Regulations Dashboard, which is an in-depth, up-to-date compilation of laws and regulations in the area of securities.

You can search the Laws & Regulations Dashboard for specific statutes or code sections, or focus in on laws from particular agencies, like the CFTC or the SEC. VitalLaw’s archives also paint a thorough picture of how laws have changed and evolved over time.

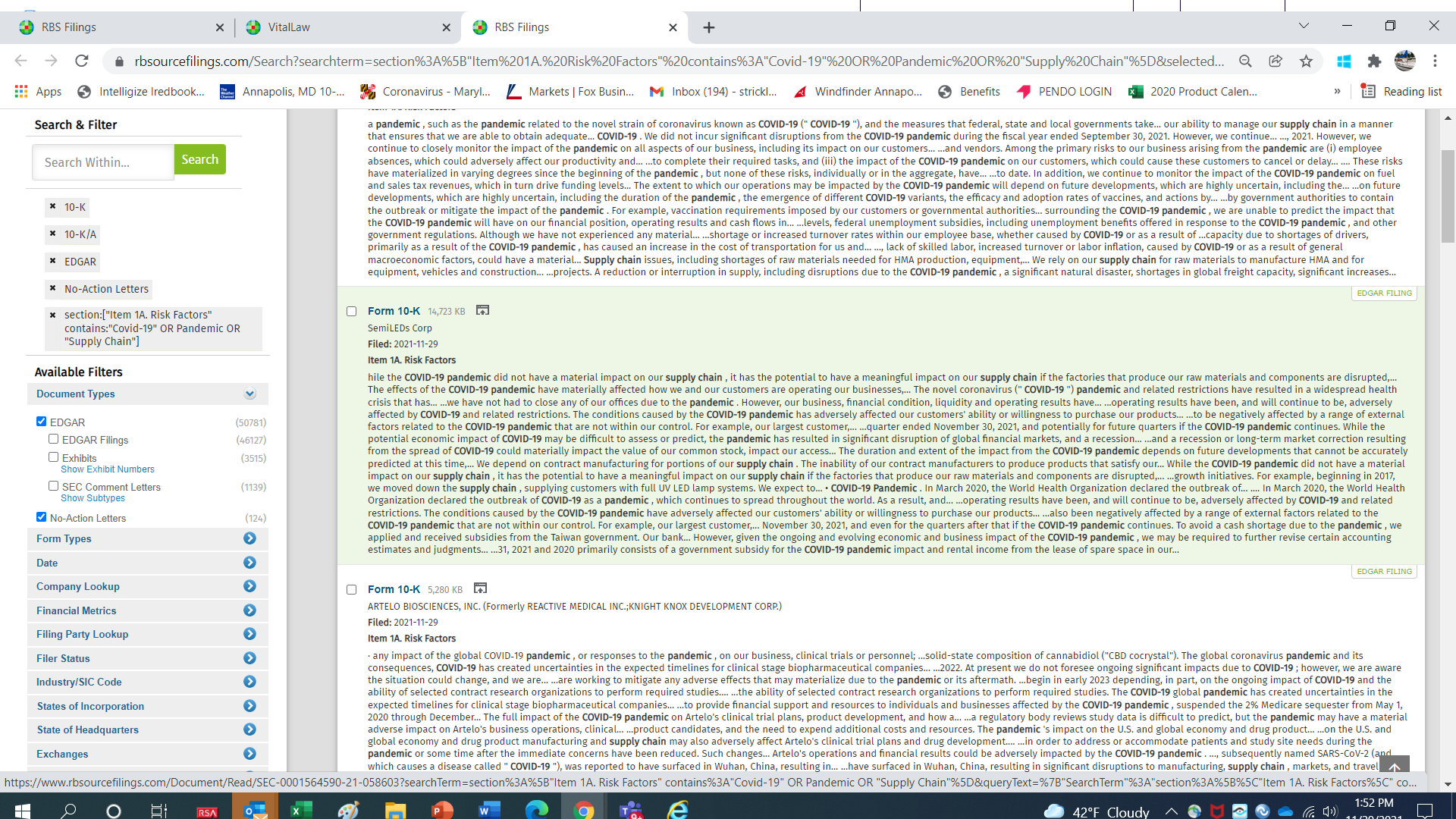

The area of securities law is unique in that lawyers can benefit greatly from seeing actual documents, not just laws and practical guidance. Say, for example, you’re preparing an SEC filing and want to see how your peers are disclosing information to the agency. Through VitalLaw, you can search in actual public SEC documents, such as annual and quarterly reports, to see how other lawyers are preparing their filings. The search capabilities extend to any exhibits that were included with filings. This can be particularly helpful when it comes to new filing or regulatory requirements, where you can get a sense of how those new developments are playing out in real time.

Another useful tool is IPO Vital Signs, which offers invaluable guidance when you’re working on an IPO.

IPO Vital Signs delivers tabular metadata to help you see broad trends in the IPO market. Because it’s a simple point-and-click tool, you don’t need to do complex searching or struggle with complex report creation. You get deep intelligence on IPOs right at your fingertips, which is something you won’t find in most research tools. VitalLaw also offers a separate database of M&A deals, where you can sort through merger and acquisition agreements by law firm, company, and more.

Simply put, if there’s something that would make the practice of securities law easier, VitalLaw has thought of it.

VitalLaw Public for Securities

You can also gain access to a universe of securities information that exists outside of the VitalLaw paywall via VitalLaw Public, even if you’re not a VitalLaw subscriber.

When you click into the securities area of VitalLaw Public, you’ll see top stories relevant to the practice area, which include accessible links to any referenced primary source materials.

In addition to the free materials, you get three complementary views of “locked” VitalLaw content every month, as well as access to all current awareness content that’s 30 days old or older.

Whether you’re handling a complex M&A transaction, preparing a regulatory filing, looking to make sure that you’re compliant with agency requirements, or handling any number of other critical tasks, the securities law area of VitalLaw will give the complete set of tools and content you need to succeed.