Introduction

Cryptocurrencies have gained immense popularity since the Great Recession as investors are wary of centralized banks. While this growth is not necessarily a problem, it has created symptoms of one. The growth and popularity of cryptocurrencies have enticed financial institutions to invest seeking higher returns.[1] Financial institutions then rehypothecate with these coins being used as collateral.[2] Cryptocurrency returns can be a gold mine, which entices firms to participate in the exchanges; however, the risks associated with cryptocurrencies are often ignored.[3] Thus, cryptocurrencies have set up the next recession by putting the market in an eerily similar position as prior to the Great Recession.

To prevent, or at least dampen, the cryptocurrency recession, I propose a government—created and—backed cryptocurrency. This cryptocurrency will be a form of what is typically called a “stablecoin.” Stablecoins are cryptocurrencies that are backed by real assets or a fiat currency.[4] The cryptocurrency will be a stablecoin backed by real dollars and precious metals currently held by the government. For the purposes of this paper, the Stablecoin will be called DolCoin. DolCoin will be very similar and have similar benefits to other cryptocurrencies currently on the market. However, the fact that it is a stablecoin makes it safer and more useful than standard coins. DolCoin will be an escape hatch for current users of cryptocurrencies to purchase to diversify away some risk associated with cryptocurrencies.

A Short Lesson in Economic History: What caused the Great Depression of 1929 and the Great Recession of 2007

Most people are familiar with commercial and investment banks, yet very few have even heard of shadow banks. In essence, shadow banking is what happens when a financial firm goes to other financial firms and borrows money.[5] In return, the loaning party is granted some piece of collateral that would become their property in case of default.[6] Commercial and investment banks use shadow banks to maintain liquidity or to double their returns because they can now get double the money for the same piece of collateral.[7] For example, imagine a consumer, “Scott,” who wants to buy a beach house. Scott takes out a mortgage to pay for this piece of real estate and offers the bank this beach house as collateral in case he cannot make payments. The bank, which we will call the Bank of Fordham (BoF), realizes that their reserves are low and are at risk of illiquidity if too many of their debtors and mortgagors default. To combat this problem, BoF contacts a larger bank, Diller and Associates (DA), and requests a loan. BoF offers Scott’s beach house as collateral for the loan. DA finds that this home is sufficient to meet their requirements and loans BoF the money. BoF can then decide whether to loan out the newly acquired money to another party and increase their revenue through interest or to keep it in their vault to maintain liquidity. The interaction between DA and BoF is shadow banking. While the offering of Scott’s home as collateral for the DA loan is known as rehypothecation.[8]

Theoretically, rehypothecation works best with information-insensitive collateral.[9] Information-insensitive debt and collateral is collateral that does not follow market trends efficiently and is relatively stable regardless of what is occurring.[10] Due to the stability of information-insensitive collateral, they are the preferred collateral for rehypothecation as shadow banks will always have some valuable consideration for their loan, regardless of market shocks.[11]

Before 2007, mortgages were considered information-insensitive and were often used for rehypothecation.[12] However, the burst in the housing bubble and the abuse of subprime mortgages showed that mortgages were, in fact, information-sensitive.[13] This new information manifested that Mortgage-Backed Securities (MBS) were information-sensitive as they quickly began to lose their value.[14] Shadow banks scrambled to recall their loans by returning the collateral they had accepted (also known as a “run on the bank”).[15]

The cause of the Great Depression was similar. Following the Great Depression, the government enacted legislation that they believed would prevent bank runs.[16] The Federal Deposit Insurance Corporation (FDIC) insured the bank deposits and provided serenity to laypeople.[17] Similarly, in response to the Great Recession, the United States government enacted a set of regulations on banks known as the Dodd-Frank Act of 2010.[18] These regulations were intended to prevent such a panic from devolving into a recession in the future by regulating banks and their practices.[19] However, unlike the FDIC, this regulation did not affect the underlying cause of the Great Recession as it did not regulate the shadow banks.[20] Shadow banking and rehypothecation still occur freely, with various forms of collateral, including cryptocurrencies.[21]

In fact, it was watching the Great Recession and its aftermath that directly led Satoshi Nakamoto to publish a white paper on a new peer-to-peer financial system known as Bitcoin.[22] Nakamoto said the banks had let down the common investor and he aimed to create a new system of money that did not rely on the banks or government.[23] Instead, he wanted his system to avoid traditional interaction with the centralized banking system and the shadow banks.[24]

When the concept of cryptocurrencies was first created, one of its main selling points was that the miners and the nodes were not concentrated in any one place, like a bank.[25] These nodes and miners were just a system of interconnected computers owned by people all over the world.[26] Thus, Bitcoin was created to circumvent traditional banks and empower the users to be in control of their own money.[27] Shadow bank use of cryptocurrencies is a dangerous bastardization of Nakamoto’s concept and will cause the next recession.

What Needs to Be Done to Prevent Banking Runs Caused by Cryptocurrencies

Investments and rehypothecation are both tools that are immensely important to maintaining a functioning economy. Investing increases the velocity of money and supports the creation of new technology. Additionally, almost every financial institution will and should attempt to maintain its liquidity or increase its returns through the rehypothecation of collateral.[28] Fortunately, in his book, “Slapped by the Invisible Hand: The Panic of 2007,” eminent economist Gary B. Gorton identifies some general steps to prevent or dampen future panics.[29]

First, Gorton puts forth that the markets should be more transparent.[30] An exacerbating factor of both the Great Recession and the Great Depression was that people did not know which banks were failing.[31] The proposed solution should aim to increase transparency in the cryptocurrency market to increase information symmetry and decrease unnecessary or unsafe rehypothecation.[32]

Second, Gorton reminds us that confidence in the system is critical.[33] Both the Great Recession and the Great Depression occurred because people did not have confidence in their banks and the market.[34] Although Gorton generalizes confidence between investors and banks, for the purpose of this paper, confidence will be split into two separate forms: internal confidence and external confidence. Internal confidence is the confidence that the financial system has in itself. Namely, since banks constantly rehypothecate collateral and other financial institutions provide funding to the banks in return for the collateral, the financial institutions must be confident in their collective strength. There is also external confidence, which is the confidence that everyday people have in the market. External confidence was the catalyst of the Great Depression.[35] Had laypeople been more confident in the banking system, then illiquidity issues could have been contained to just a few institutions.[36] Additionally, the long period of constant growth between the two market panics and downturns existed because FDIC insured deposits.[37] This increased the external confidence as laypeople did not have to worry that their savings would be zapped if any bankers made some bad investments or loans.[38] With the relative recency of the Great Recession, it is not unlikely that consumers and investors are still unsure about the market. Additionally, cryptocurrencies have become pivotal market levers despite the volatility of their valuation. Consequently, any proposed solution should be designed to reestablish external confidence in the market, like the FDIC did after the Great Depression.

What is the Issue?

The market for cryptocurrencies is neither transparent nor confidence-inducing for most people as users and holders are wary of the technology and its valuation. Additionally, financial institutions purchase volatile and unsafe coins and rehypothecate them even though they recognize that the valuation is speculative and unbacked.[39] This creates highly volatile valuations that could plummet at any minute and cause a bank run that would lead to another devastating recession or depression. Meanwhile, current regulations attempting to increase transparency and promote stability in cryptocurrencies are either ineffective or inconsistently enforced.[40]

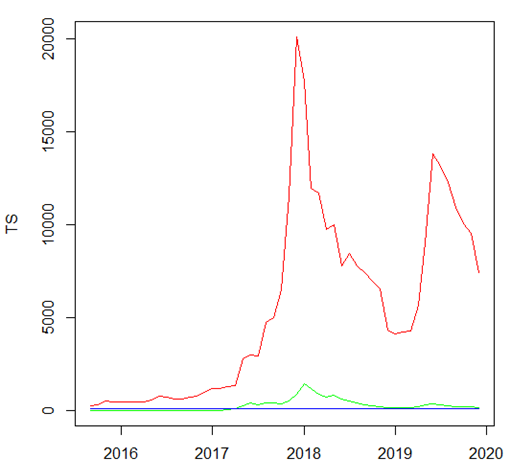

The cryptocurrency market has been shown to be highly volatile from inception. Figure 1, presented below, compares the volatility of Bitcoin (red line), Ethereum (green line), and the United States Dollar Index (blue line). The U.S. Dollar Index measures the U.S. Dollar against a basket of foreign currency and translates that back into U.S. Dollars. The time series was created from the monthly high valuation of each asset from August 2015 to December 2019.[41]

| Figure 1: The red line represents market valuation of Bitcoin, the green is the market valuation of Ethereum, and the blue line is the U.S. Dollar Index. |

The graph clearly shows that Bitcoin has experienced extreme spikes and dips in the past five years.[42] Ethereum was also extremely volatile, although less than Bitcoin. The U.S. Dollar index, however, has been relatively stable during this period. The cryptocurrency market, as shown above, is much more information-sensitive and volatile. The valuation of each cryptocurrency relies heavily on outside forces such as public opinions, artificial supply/demand, cryptocurrency competition, and the usefulness of the coin.[43] The relative volatility of cryptocurrency valuation destroys both external and internal confidence in the strength of cryptocurrencies and the modern trends of the market and establishes that they could cause the next recession.

Even with this extreme volatility and its implications on confidence, Cryptocurrency proponents point to the continuous bullish market for these tokens as evidence that they are information-insensitive.[44] Nevertheless, these claims have not been examined and will not be tested thoroughly until a market panic or a shock occur. Although a small taste of the possible valuation crash can occur at any time, as put forth by the 51% attack on Ethereum.[45] Following that attack, the valuation of Ethereum plummeted as investors realized that attacks, although still difficult and improbable, were not impossible and could lead to tremendous losses.[46] Acts like this cause a sharp decrease in external and internal confidence in the market as the technology that once seemed like the infallible future of finance will prove to be flawed and possibly dangerous, like Mortgage Backed Securities.

Furthermore, because cryptocurrency networks are entirely digital with no physical counterpart, the entire valuation and profitability of cryptocurrencies are theoretical. For instance, Satoshi Nakamoto can significantly influence the supply and demand of bitcoin by cashing out his/her/their tokens since he/she/they own(s)[47] more than four percent of all of the bitcoin that will ever be produced.[48] Furthermore, a recent study clarified that the valuation of Bitcoin relies less on the activity of small investors and more on the activity of one single “whale” investor.[49] Thus, even if one assumes that attacks on cryptocurrencies will decrease or become obsolete, whales and hidden players in the market can still have mysterious and profound effects on valuation that hurt external and internal confidence in the digital currency and proves their opacity.

Is there a Solution?

Ethereum Foundation Researcher Vlad Zamfir posits that the government may create an alternative to popular cryptocurrencies.[50] In fact, the United States Government should strongly consider creating a cryptocurrency. This new cryptocurrency, backed by the government, would increase the stability of the cryptocurrency markets. This would increase external and internal confidence in the cryptocurrency investment world as the U.S. government and dollar are generally seen as stable and safe investments. This new cryptocurrency would act as a safe haven in case of a market shock as investors would be able and incentivized to trade their highly volatile cryptocurrencies for the more stable, government-issued, and insured cryptocurrency.

Because the government would be operating this cryptocurrency, the details behind it would be precise. As stated above, current cryptocurrencies keep many of their details and characteristics veiled.[51] The government could establish a limit based on their holdings and can then precisely publish the number of coins currently being held, bought, and sold by the government. Thus, a cryptocurrency established by the government would be more transparent than currently existing cryptocurrencies, which would make it safer and more trustworthy.

You may be wondering how this will stop another bank run like the ones that caused the Great Depression and the Great Recession. First, DolCoins will be less volatile than current cryptocurrencies. As stated above, the valuation of cryptocurrencies is based on various details, such as supply/demand, media opinion, and usability.[52] DolCoins will be capped at a specific number of coins, the government will be transparent with the number of coins it holds and how it affects the supply and demand with these coins, and the coins will be widely accepted due to their government backing. Thus, the volatility of the coins will be controlled. This will increase external confidence and prevent sudden valuation shocks that will panic investors.

Moreover, these coins will be much safer to rehypothecate than current cryptocurrencies and MBS. The coins will provide the cryptocurrency market what the FDIC offered the banks following the Great Depression. The government’s backing by precious metals and fiat currency currently held means that the government will insure them. Thus, regardless of the market valuation of the coin, DolCoins will have a real value. Banks that rehypothecate these coins as collateral, and shadow banks that accept these coins as collateral, will be able to properly value the coins based on their stable asset valuation as well as their market valuation. Accurate rehypothecation will increase information symmetry between banks and shadow banks, thereby preventing a shadow banking run like that which caused the Great Recession.

Additionally, the coins will have a more stable market valuation and will be less likely to experience shocks. Even if companies used this currency to rehypothecate, these coins would be much more information-insensitive than their currently existing counterparts. Since this coin would be backed by the government and real assets, the public’s view of the cryptocurrency is unlikely to waiver. Banks will not fear shocks that would substantially affect the valuation of the coin, thereby protecting firms from sudden financial losses resembling that of the MBS market in 2007. This stable market valuation would allow banks to rehypothecate with fewer worries, thereby increasing internal confidence.

Criticisms of DolCoin

If the United States government fails or becomes more volatile, this sudden change will inarguably hurt the valuation of DolCoins. However, this is an unrealistic hypothetical as bond ratings from Standard & Poor’s, Fitch, Moody’s have established that American bonds are stable and rated them AA+, AAA, and Aaa.[53] This shows that any risk assumed by the purchase of government-issued bonds is of high investment grade and carries little chance of default due to governmental instability.[54] Thus, although it is not impossible that the government may face some hardships in the future, it is unlikely that the government will be forced to default and DolCoin will be relatively safe.

Cryptocurrency users are typically wary of government intervention.[55] This fear could be combatted through smart online advertising and a clear/honest white paper. The government could inform people that although DolCoin is created and backed by the government and tangible assets, it will be free of government intervention. While the government may need to operate some nodes in the beginning, government intervention will cease entirely once DolCoin becomes popular enough that neutral third parties begin to establish nodes for them. This is likely to happen quickly as miners will recognize that the currency has real value behind it and that there will likely be a time where the number of transactions will increase as the usefulness of the coin increases. Thus, although there will be some government intervention in the beginning, government intervention will decrease rapidly as third-party users increase. Thereby, while not unfounded, the worries of decentralists will be eased because the government will simply act as a creator and insurer.

Also, the government-backing would be an asset of DolCoin. Businesses and consumers are more likely to use a coin that is backed by the government because its valuation would be much more stable than other coins. The coins could be more efficiently accepted as a form of currency or a medium for exchange and the valuation of the coin would increase and provide a stable form of investment with positive returns for the investors because of the government-backing.

Traditional Cryptocurrency Characteristics Applicable to DolCoin

If the government implements this plan of action, there are a few characteristics from the original cryptocurrencies that should be retained. First, as stated before, the number of coins should be limited. By limiting the number of coins on the market, the government would ensure that all of coins could be backed and insured by fiat currency and precious metals. Additionally, limiting the number of coins would maintain investor confidence and increase transparency.

DolCoin should also be decentralized. The decentralized peer-to-peer model was one of the main selling points of the cryptocurrency market.[56] This decentralized system meant that government bodies and large banks that caused or allowed the most recent recession would not influence the markets. Although DolCoin is government-backed, the government should not take part in mining or approving the transactions that occur. By limiting government interaction, investors that are wary of the government and centralized banking would be more confident in the system. Furthermore, keeping the coins decentralized allows more people to take part in the market by becoming nodes and mining transactions. This will further increase the velocity of transactions and the transfer of money while putting DolCoins in the hands of new investors.

The government should also aim to keep DolCoin anonymous. Cryptocurrencies are popular partly due to their pseudo-anonymity. Traditional currency or valuable assets leave a paper trail that makes it easier for the government to find the user.[57] While this is often regarded as a safety measure that prevents crime, it is limiting. It is estimated that the U.S. underground market, which supplies the underworld with drugs and other illegal items, is worth $2.46 trillion.[58] Many of these criminal market interactions use cryptocurrencies.[59] Instead of continuing the frivolous, albeit honorable, attempts to stop the illegal activity, the government should recognize the possibility of increasing taxable transactions. Allowing the users to remain anonymous and to use their DolCoins as they please, means that the government would be able to tax the illegal market.

Rather than constant policing of DolCoin and its use, the government should implement a solution through crowdsourcing. In essence, the government could create and operate a “snitching” system, which would allow users to identify fraudulent activity.[60] Then, the government could publish the most fraudulent public keys. This would increase external confidence in DolCoin as users will feel protected against scammers while maintaining decentralization and pseudo-anonymity.

Unresolved Issues with DolCoin

One consistent issue that currently exists and is likely to exist with DolCoins is whales.[61] These are cryptocurrency investors that hold large quantities of the currency and can directly affect the valuation of the coin.[62] These whales can artificially inflate/deflate the valuation of DolCoins.[63] The issue with whales is, mostly, unavoidable. However, one way to attempt to combat this is by driving up the popularity of DolCoins, causing many investors to purchase the limited stock of DolCoin. However, this is an unproven theory and has even failed in Bitcoin.[64]

Another issue is foreign holdings of cryptocurrencies. It is not uncommon for foreign powers to use cryptocurrencies to fund their activities.[65] If a foreign group holds DolCoin, they can use it to fund their operations and to incite international transactions using the coins. This would, effectively, mean that the government would be funding anti-American sentiments and facilitating foreign attacks. While the government can monitor suspicious accounts, such surveillance would fuel the fears of decentralist coin users. This could cause a drop in the demand for the coin. Thus, there is a catch-22 with DolCoin, foreign parties can obtain a new international currency and, although the government could stop or be watchful over suspicious accounts, they should not do so as it would drive down the demand of the coin.

Additionally, the issue of mining pools poses a serious threat. Mining pools occur when one person, or a group of people, own and operate multiple nodes.[66] This can be a springboard for 51% attacks.[67] Mining pools can also be controlled by foreign bodies that could launch attacks against DolCoin.[68] Additionally, mining pools increase centralization and the entrance cost of any future nodes as they make it more difficult for non-pooled nodes to claim rewards.[69] While there are some theoretical solutions to this problem, none of them have been implemented or tried on a real cryptocurrency.[70] Accordingly, further research needs to be done in the world of cryptocurrencies before implementing any theoretical solutions to mining pools.

Conclusion

The creation of DolCoin, a government-backed cryptocurrency, provides the best solution to the current issues surrounding cryptocurrencies and the impending recession. DolCoin would meet the necessary requirements that would prevent cryptocurrencies from causing the next recession. The cryptocurrency market would become more transparent as users would have a token that is backed by the government, which would clearly put forth the coin’s standards. DolCoins would also increase internal and external confidence in the cryptocurrency market as this coin would be backed by the U.S. Dollar and insured by government bodies, making them rehypothecation-friendly. Additionally, investors could trust that the risk of shock to the valuation of DolCoins would be much lower than that of comparable cryptocurrencies. This increase in confidence lowers the possibility of a bank run by either shadow banks or consumers. Thus, the creation of a government-backed cryptocurrency would relinquish market worries about recessions or, alternatively, prevent the exacerbation of a recession by reducing the systemic risk. Therefore, the best solution to the threat of a cryptocurrency recession is the creation of a government-backed and insured cryptocurrency, like DolCoin.

[1] See Anna Irrera, Exclusive: Banks to Invest Around $50 Million in Digital Cash Settlement Project – Sources, Reuters (May 16, 2019) https://in.reuters.com/article/us-banks-blockchain-exclusive/exclusive-banks-to-invest-around-50-million-in-digital-cash-settlement-project-sources-idINKCN1SM2U0.

[2] See generally Sebastian Infante et al., The Ins and Outs of Collateral Re-use, Bd. of Governors of the Fed. Rsrv. Sys. (Dec. 21, 2018), https://www.federalreserve.gov/econres/notes/feds-notes/ins-and-outs-of-collateral-re-use-20181221.htm.

[3] See, e.g., David Mussington, Financial Institutions Must Not Ignore Risks of Cryptocurrencies, The Globe and Mail (Feb. 26, 2018) https://www.theglobeandmail.com/report-on-business/rob-commentary/financial-institutions-must-not-ignore-risks-of-cryptocurrencies/article38122059/.

[4] See Bilal Memon, A Guide to Stablecoin: Types of Stablecoins & Its Importance, Master the Crypto, https://masterthecrypto.com/guide-to-stablecoin-types-of-stablecoins/ (last visited Nov. 29, 2019).

[5] See Zoltan Pozsar et al., Shadow Banking 1-7 (2010).

[6] See id.

[7] See id.

[8] See Madhuri Thakur, Rehypothecation, WallStreetMojo, https://www.wallstreetmojo.com/rehypothecation/ (last visited Mar. 22, 2021).

[9] See Gary Bernard Gorton, Slapped by the Invisible Hand: The Panic of 2007 7 (2010).

[10] See id. at 64.

[11] See id.

[12] See id. at 22.

[13] See id.

[14] See id.

[15] See id. at 123.

[16] See id.

[17] See id.

[18] See Wall Street Reform: The Dodd-Frank Act, The White House https://obamawhitehouse.archives.gov/economy/middle-class/dodd-frank-wall-street-reform (last visited Nov. 27, 2019).

[19] See id.

[20] See U.S. Dep’t of Treasury, A Financial System That Creates Economic Opportunities – Asset Management and Insurance (2017).

[21] See generally Sebastian Infante et al., supra note 2.

[22] See generally Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System (2008) https://bitcoin.org/bitcoin.pdf.

[23] See id.

[24] See id.

[25] See id.

[26] See id. at 2.

[27] See id. at 1.

[28] See Sebastian Infante et al., supra note 17.

[29] See generally Gorton, supra note 6.

[30] See id. at 175 – 84.

[31] See id. at 28 – 35.

[32] See id. at 175 – 84.

[33] See id.

[34] See id. at 28-35, 175-84.

[35] See id. at 28 – 35.

[36] See id.

[37] See Gorton, supra note 6 at 54-59.

[38] See George G. Kaufman, Deposit Insurance, The Libr. of Econ. and Liberty, https://www.econlib.org/library/Enc1/DepositInsurance.html (last visited Nov. 29, 2019).

[39] Irrera, supra note 1.

[40] See Rosario Girasa, Regulation of Cryptocurrencies and Blockchain Technologies (2018).

[41] Historical price data used to create the graph comes from Yahoo! Finance, https://finance.yahoo.com/ (last visited Mar. 8, 2021).

[42] This graph has been edited to exclude information after 2020 as Bitcoin has subsequently seen impressive spikes that make the graph illegible but further prove the volatility of Bitcoin (BTC). See Bitcoin USD, https://finance.yahoo.com/quote/BTC-USD?p=BTC-USD&.tsrc=fin-srch (last visited Mar. 10, 2021).

[43] See Chrisjan Pauw, How Cryptocurrency Prices Work, Explained, Cointelegraph (July 24, 2018), https://cointelegraph.com/explained/how-cryptocurrency-prices-work-explained.

[44] See, e.g., Carmen Reinicke, Bitcoin Has Become an Unlikely Safe Haven as Global Turmoil has Rocked Markets. But Not Everyone Thinks That’s a Good Idea, Mkts. Insider (Aug. 19, 2019), https://markets.businessinsider.com/currencies/news/bitcoin-safe-haven-asset-commentary-pros-cons-2019-8-1028457025.

[45] A 51% attack occurs when a single party controls more than 51% of the nodes mining the cryptocurrency. This control allows the party to create a separate chain and redirect funds as they see fit through double spending. See Gina Clarke, After Ethereum Classic Suffers 51% Hack, Experts Consider – Will Bitcoin Be Next?, Forbes (Jan. 9, 2019), https://www.forbes.com/sites/ginaclarke/2019/01/09/after-ethereum-classic-suffers-51-hack-experts-consider-will-bitcoin-be-next/#79c2b716a56b.

[46] See id.

[47] Satoshi Nakamoto’s true identity, including any details pointing to his/her/their preferred pronouns, has yet to be revealed. See, e.g., Zoe Bernard & Grace Kay, The Many Alleged Identities of Bitcoin’s Mysterious Creator, Satoshi Nakamoto, Bus. Insider (Feb. 26, 2021), https://www.businessinsider.com/bitcoin-history-cryptocurrency-satoshi-nakamoto-2017-12.

[48] Sead Fadilpašić, How Many Bitcoins Does Satoshi Have, Cryptonews (Aug. 22, 2018), https://cryptonews.com/news/how-many-bitcoins-does-satoshi-have-2487.htm.

[49] See generally John M. Griffin & Amin Shams, Is Bitcoin Really Un-Tethered? (2018).

[50] See Tim Copeland, Researcher Vlad Zamfir: Ethereum’s Legal Question is an Inevitable Crisis, Decrypt (Oct. 10, 2019), https://decrypt.co/10215/researcher-vlad-zamfir-ethereums-legal-question-is-an-inevitable-crisis.

[51] See, e.g., David Z. Morris, Tether Now Admits It’s Not Fully Backed by Dollars, Breakermag (Mar. 14, 2019) https://breakermag.com/tether-now-admits-its-not-fully-backed-by-dollars/ (explaining that Tether, a cryptocurrency that would be backed in a one-to-one ratio by silver and fiat currency, was only backed by 74 cents per dollar).

[52] See supra text and figure accompanying notes 41-43.

[53] Rating: United States Credit Rating, Countryeconomy.com, https://countryeconomy.com/ratings/usa (last visited Nov. 29, 2019).

[54] See Brian Edmondson, What Is a Bank Credit Rating?, The Balance (Sept. 17, 2020), https://www.thebalance.com/what-is-a-bank-credit-rating-4586357.

[55] See, e.g., Kevin Breuninger, Criminal Activity Will Spur Government Intervention and Kill Bitcoin: Hermitage CEO Bill Broder, CNBC (Jan. 23, 2018), https://www.cnbc.com/2018/01/23/criminal-activity-will-spur-government-intervention-and-kill-bitcoin.html.

[56] See Nakamoto, supra note 18.

[57] See M. Alex Johnson, U.S. Aims to Track ‘Untraceable’ Prepaid Cash Cards, NBC News (Sept. 1, 2011), https://www.nbcnews.com/news/world/u-s-aims-track-untraceable-prepaid-cash-cards-flna121083.

[58] Matthew Johnston, How Big is America’s Underground Market?, Investopedia (Nov. 9, 2019), https://www.investopedia.com/articles/markets/032916/how-big-underground-economy-america.asp.

[59] See Jason Bloomberg, Bitcoin: ‘Blood Diamonds’ of the Digital Era, Forbes (Mar. 28, 2017), https://www.forbes.com/sites/jasonbloomberg/2017/03/28/bitcoin-blood-diamonds-of-the-digital-era/#d9ec567492a5.

[60] See, e.g., Jonathan Zuckerman & Matthew Stock, Report Cryptocurrency Fraud and Earn a Whistleblower Award, 11 Nat. L. Rev. 70 (May 21, 2020). https://www.natlawreview.com/article/report-cryptocurrency-fraud-and-earn-whistleblower-award.

[61] See Griffin & Shams, supra note 40.

[62] See Arsenii Veriho, Who are the Cryptocurrency Whales & How They Affect to the Coin Market, Hackernoon (Feb. 4, 2019), https://hackernoon.com/who-are-the-cryptocurrency-whales-how-they-affect-to-the-coin-market-a42d2291cbe3.

[63] See id.

[64] See Griffin & Shams, supra note 40.

[65] Nathain Reiff, Which Governments are Hoarding Bitcoin?, Investopedia (Jan. 2, 2018), https://www.investopedia.com/news/which-governments-are-hoarding-bitcoin/.

[66] See Matt Hussey, What is a Mining Pool?, Decrypt (Jan. 23, 2019), https://decrypt.co/resources/mining-pools.

[67] See Ofir Beigel, 51% Attack Explained – A Beginner’s Guide, 99Bitcoins (Nov. 19, 2020), https://99bitcoins.com/51-percent-attack/#:~:text=a%2051%25%20Attack%3F-,A%2051%25%20attack%20describes%20a%20situation%20where%20a%20certain%20miner,Prevent%20transactions%20from%20being%20confirmed.

[68] See generally Daniel Palmer, Venezuela Legalizes Crypto Mining but Will Force Industry into National Pool, Coindesk (Oct. 1, 2020), https://www.coindesk.com/venezuela-legalize-cryptocurrency-mining-national-pool.

[69] See generally Roger Huang, The ‘Chinese Mining Centralization’ Of Bitcoin and Ethereum, Forbes (Dec. 29, 2020), https://www.forbes.com/sites/rogerhuang/2021/12/29/the-chinese-mining-centralization-of-bitcoin-and-ethereum/?sh=261e0aa12f66.

[70] See, e.g., Ittay Eyal & Ermin Gun Sirer, How to Disincentivize Large Bitcoin Mining Pools, Hacking, Distributed (June 18, 2014), https://hackingdistributed.com/2014/06/18/how-to-disincentivize-large-bitcoin-mining-pools/.