Law Office Management: Best Practices

MyCase

OCTOBER 20, 2022

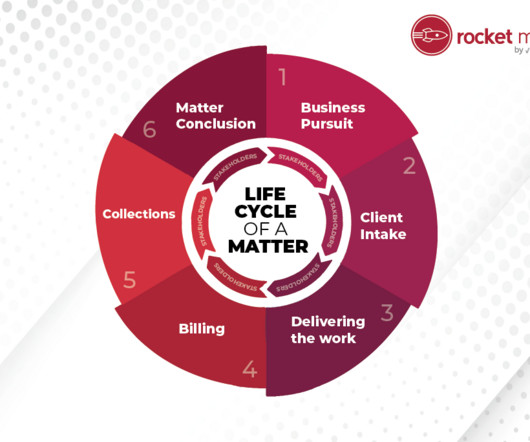

Your firm’s law office management and organizational procedures can mean the difference between running a profitable business or running your business into the ground. There are several complex components involved in successful law office management. Why is High-Quality Office Management Important?

Let's personalize your content