For tax lawyers and accountants, a major pain point is the time they spend drawing complex entity and relationship diagrams — diagrams that map the major players involved in a client’s tax scenario and the relationships among them.

Until now, the state of the art for creating these diagrams has been Microsoft PowerPoint, according to Benjamin Alarie, cofounder and CEO of Blue J, a company that provides AI-powered legal and tax research and analysis software. Tax professionals can spend many hours in PowerPoint — at their standard billable rates — drawing shapes and connecting lines, he said.

The company says it consistently received customer feedback indicating that the time and effort spent drawing these complex diagrams was a major source of frustration, and that existing solutions did not meet the need for simplicity and tax-specific functionality.

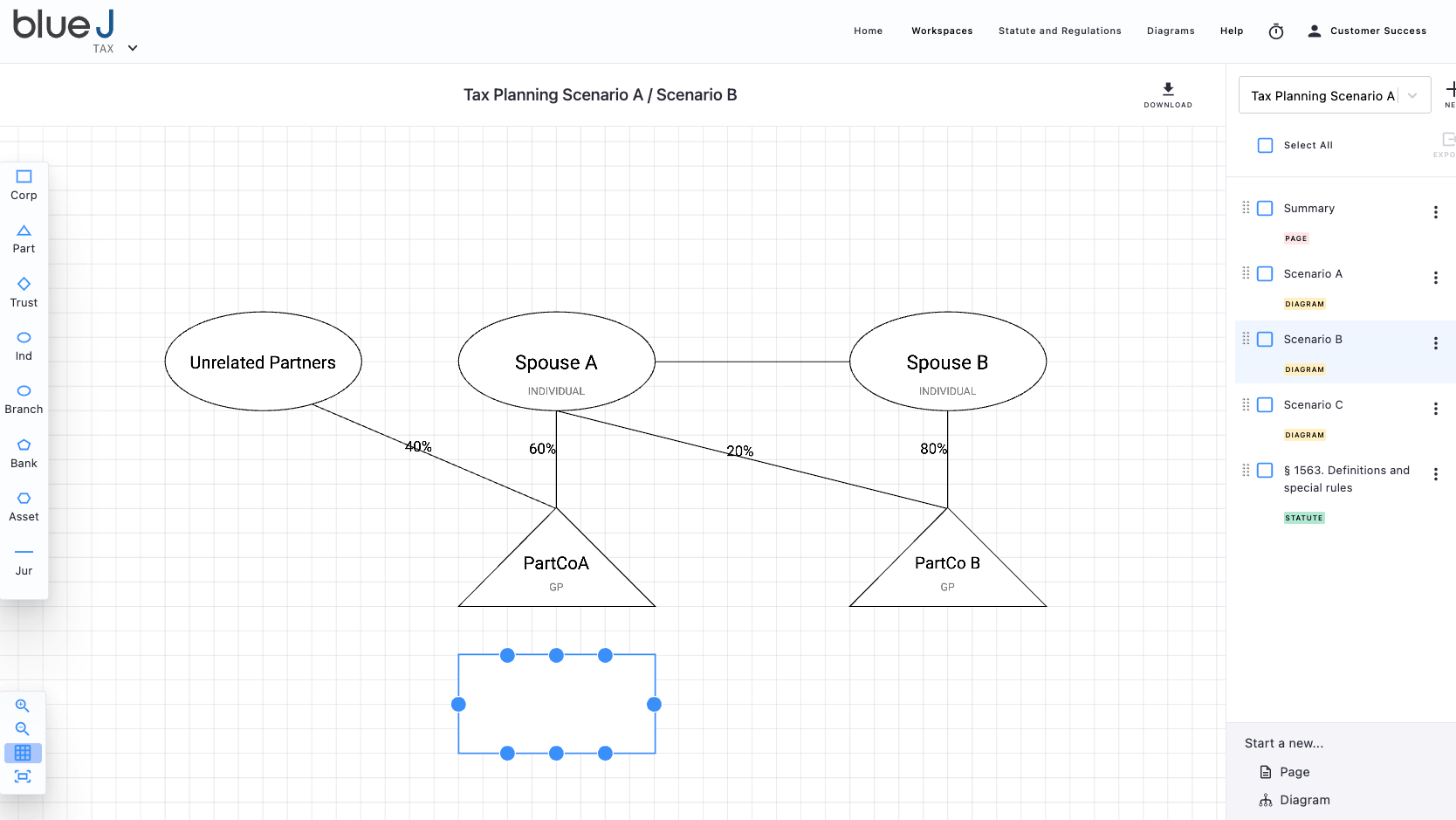

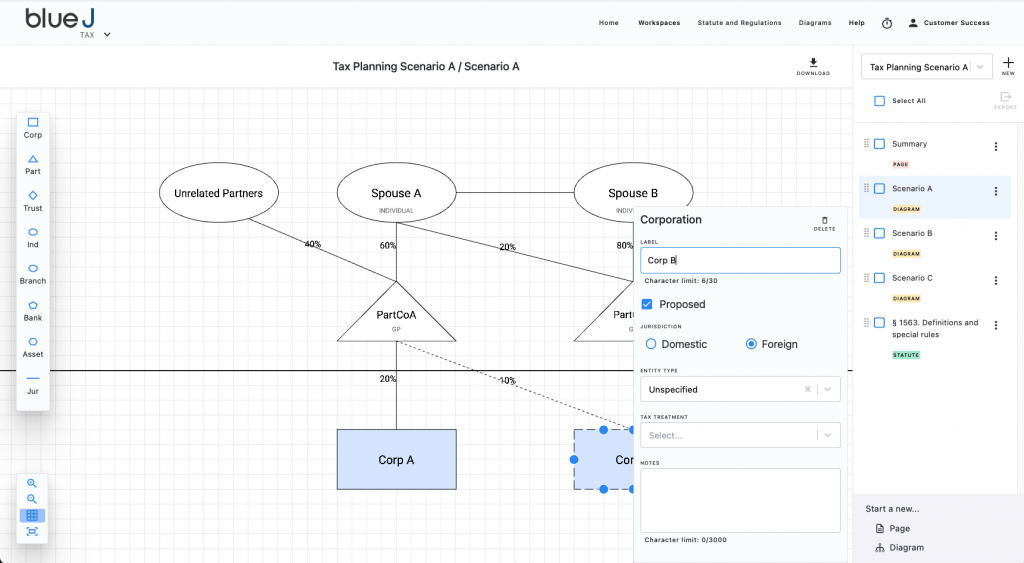

Aiming to solve this problem, Blue J is today introducing its new Entity and Relationship Diagramming feature as part of its flagship Blue J Tax platform. This first-of-its-kind feature allows users to drop common entity shapes quickly and easily onto a canvas, draw connecting relationships between entities, and capture key data related to the entities and relationships.

“Blue J’s new tax diagramming solution streamlines documenting and analyzing the tax implications of the complex relationships among entities,” Alarie — who is also a professor of business law at the University of Toronto — told me.

“Blue J’s tax diagramming solution is purpose-built for tax practitioners and opens up new ways to leverage AI and machine-learning in analysis of the merits of tax positions.”

Today’s release follow’s the Toronto-based company’s announcement in August that it had raised $9 million in Series B funding to accelerate development of its tax analysis platform and brought on new executives to lead its sales and marketing.

More Than A Drawing Tool

The feature provides a simple interface by which users can more easily display the relationships among all entities involved in their client’s tax scenario.

Users can create a diagram from scratch or chose from templates Blue J has created for numerous situations involving common structures and reorganizations. When the diagram is completed, the user can export it to PDF or PNG to present to the client or share with colleagues.

Unlike PowerPoint, the system is specifically designed for tax practitioners and tax-specific issues. In addition, the company says, it is more than just a drawing tool — it also captures data about the entities and the relationships to access further insight into how the legislation and regulations interplay with their structure.

Core Platform Predicts Outcomes

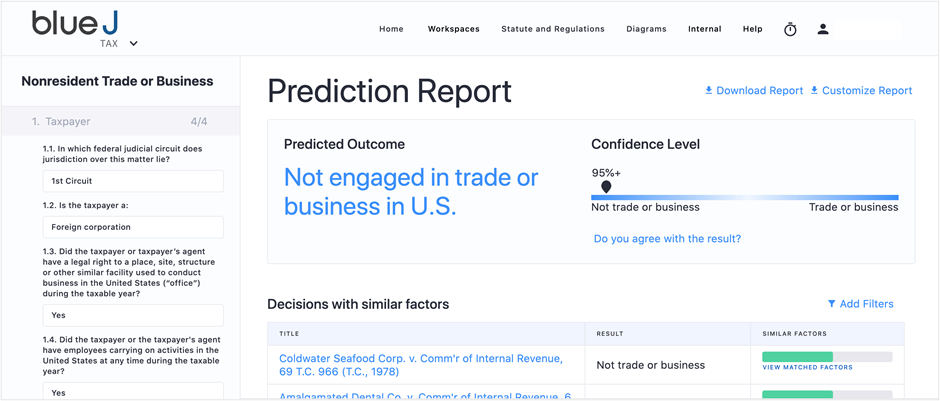

Blue J’s core product uses AI to analyze tax scenarios and predict how courts will resolve them, often with 90% accuracy, the company says. (The platform tells you the confidence level of its prediction.)

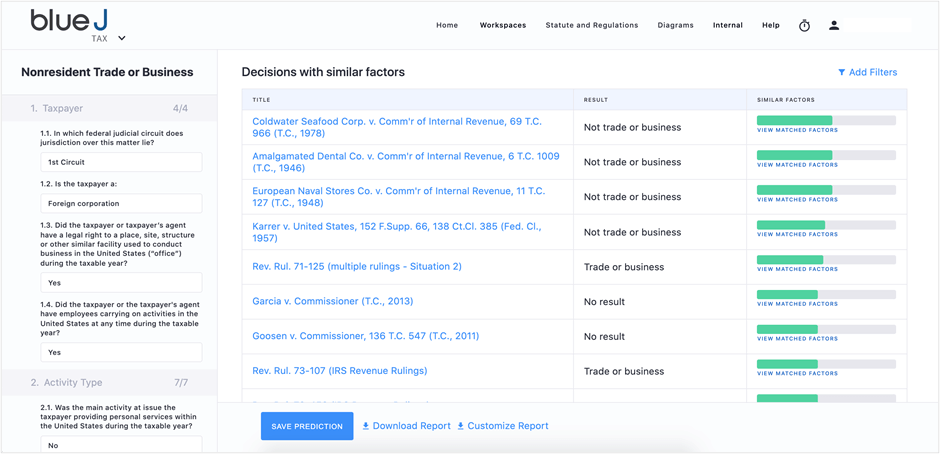

Blue J says its legal experts have reviewed all the decisions in a given area of tax, coded all the relevant facts at play in those decisions, and then used a proprietary AI algorithm to build its prediction tool based on those factors.

The platform steps a user through a series of questions to collect facts, and the tool returns a precise prediction of how the courts are likely to rule in that scenario. Users can then adjust the factors in the case dynamically to see the impact on the outcome prediction.

According to Blue J, that same algorithm allows users to review all the decisions that match a fact pattern with respect to a specific tax issue, eliminating the need to search for, scan, and read large numbers of irrelevant decisions. With a click, a user can create a research summary that gathers the decisions and an explanatory narrative, ready for review by the client.

Another module provides workspaces for statute analysis, where users can work with a clean, easily editable version of the tax statute. Sections can be highlighted, hidden, and annotated for collaboration with colleagues.

$9M Financing and New Hires

The company’s Series B financing was led by Generation Ventures and included participation from returning investors Relay Ventures, Mistral Venture Partners and LDV Partners. The round brings the company’s total financing to $18 million.

The new executives who joined Blue J were:

- Joshua Tanzola, formerly with Actionstep and Clio, as vice president of global sales.

- Peter van Hezewyk, formerly with Thomson Reuters, where he led marketing strategy for global large law firms, as vice president of marketing.

Blue J’s technology evolved out of IBM’s 2014 Watson Challenge at the University of Toronto. Alarie, then an associate dean, served as a judge, and became intrigued by the possibilities of applying AI to tax law. By 2015, the company built its initial prototype, and it released it commercially a year later, initially in Canada, but later expanding to the U.S. market.

Robert Ambrogi Blog

Robert Ambrogi Blog